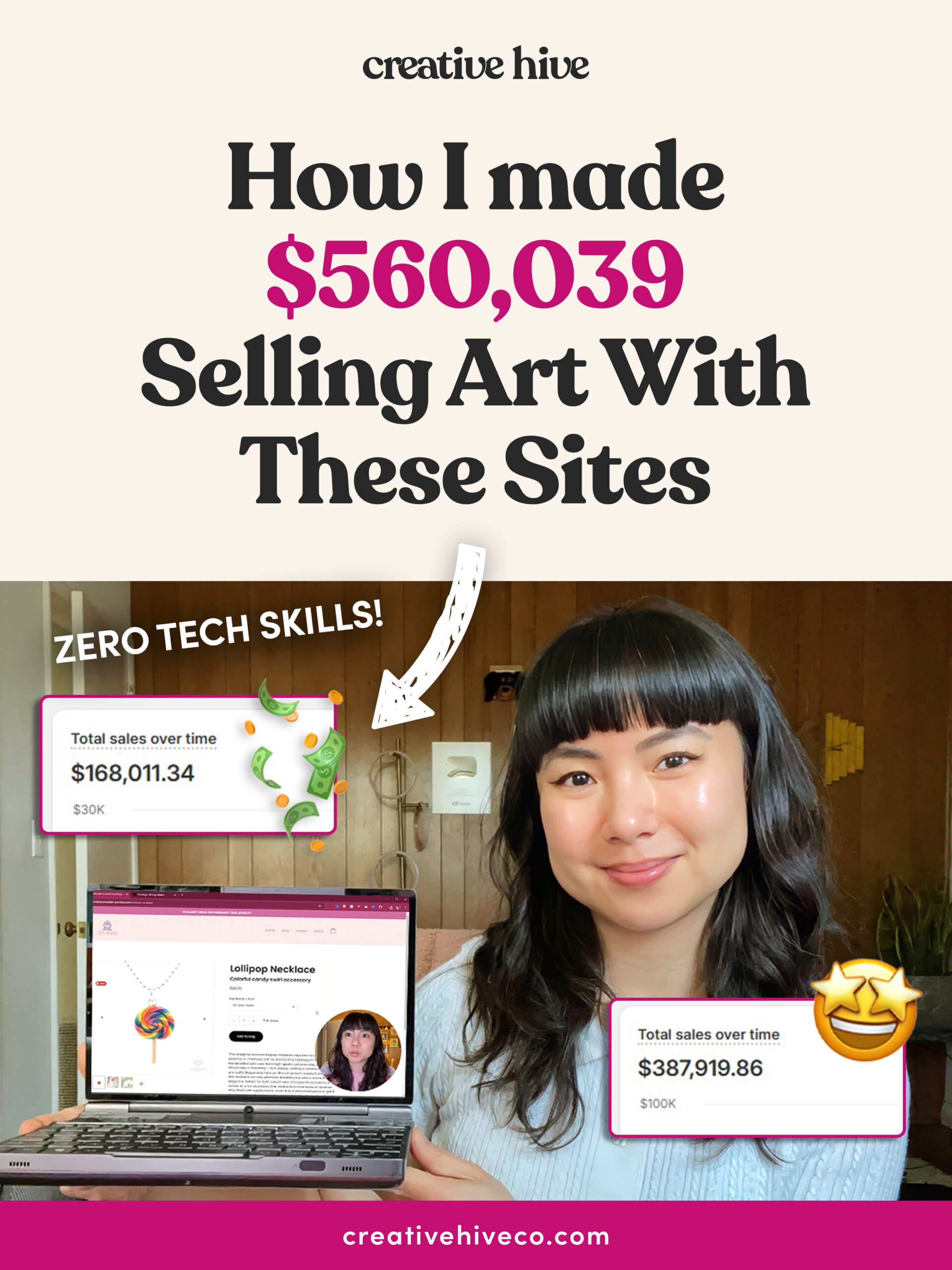

I want to help you build a sustainable, profitable handmade business that makes you consistent income and sales. I only ever teach or recommend marketing, social media, pricing, production and branding tips that I’ve personally used successfully in my own 7-figure handmade businesses.

I'm Mei, from Los Angeles!

Read More

Popular Posts You'll Love

Looking for something?

Categories

starting a business

get more traffic

running a business

make more sales

branding

growing a business

mindset & productivity

podcasts

pricing & money

product photography

reviews

selling on etsy

selling on amazon

social media

selling wholesale

- Facebook0

- Twitter1

- Pinterest11

- 12shares

You’re passionate, motivated, hardworking, and ready to start your own handmade business.

There’s just this one thing that’s stopping you or that really worries you… taxes!

I know managing taxes as a new business owner can feel daunting – even for me who’s been doing this for 15 years now.

You might be hesitating to start your business altogether, because you may be afraid of making tax mistakes that could come back to haunt you.

It’s serious stuff!

It would be such a shame to let tax anxiety stop you from making your dreams come true especially if you really want to start your own handmade business.

I’m going to offer some tips on what to do and what you need to set up ASAP when it comes to taxes as a new business owner.

It’s important to note that I am not an accountant or a tax professional – so this isn’t “professional” advice.

But I have been running my businesses for over a decade now, and I’ve had to deal with a lot of taxes.

And let me tell you, once you understand these things, they’re really not that complicated.

There are many topics in the world of taxes that we could dive into, but I’m only going to cover five major points for now.

Today, I’m going to help you become tax-confident.

1. Separate Accounts

My first piece of advice is to separate your personal and business accounts.

This can be as simple as opening two regular checking accounts at your bank – one for personal, one for business.

Why is this important?

When you blend your business money with your personal money, it can get super hard to keep track of where your money is coming from.

Therefore, it can be confusing how much you should be putting toward business taxes.

When you go into business for yourself, you need to pay income tax as well as self employment tax.

How much you owe in taxes is hinged on knowing your business revenue and expenses.

You need to be crystal clear on your business numbers.

The more organized you are, the easier it will be to get your taxes in order.

You won’t have to spend hours dissecting every single transaction to figure out if it’s related to your business or not.

This gives you a simple, clean record that you can cipher through come tax season.

With that in mind, I recommend practicing spending money ONLY from your business account.

Every time you need to make a transaction for your business, dip into the business account instead of the personal account that you would use for things like groceries or Netflix.

Tax season is so much less stressful when you’ve got everything systematized.

Practicing good bookkeeping habits throughout the year will make trying to figure out which purchases came from which account a lot easier.

2. Bookkeeping

You should seriously look into using bookkeeping software.

Whether you learn how to use it yourself or you outsource, this software will be a total lifesaver during tax season.

I personally use Bench.co.

Bench is great for me because it’s a bookkeeping software that comes with a real life bookkeeper who balances your books for you!

Through Bench, I can connect with all of my sources of income at once.

Everything from my:

- Shopify store

- Etsy

- Paypal

- and anywhere else I might be making money

It also syncs your expenses, like your business credit card or any spending that takes place directly through your bank accounts.

It goes without saying that bookkeeping software is a MUST HAVE.

As business owners, we have SO MUCH to keep track of.

Our money is coming in and out of a variety of places, so any software that can help us stay efficient and organized is a game changer.

It is so important for any business owner to know where they stand financially at all times.

There are plenty of other bookkeeping softwares out there besides Bench.

Quickbooks Online is probably one of the most popular options.

Personally, I thought Quickbooks was a little bit harder to use for people who aren’t professional bookkeepers.

I always say, if software is hard to use, you’re not going to use it.

Bench is just a lot more user friendly for the layman.

WaveApps is another software that has really positive reviews, and I also loved using Godaddy Bookkeeping.

Do some research, weigh the costs, read the reviews and check out their features to find the best fit for you.

The best part about bookkeeping software is that they help you easily calculate your profit, once you’ve connected all your financial accounts into the software.

The alternative would be to use spreadsheets and import all your transactions, which includes money going in and money going out, and doing all the organizing from within said spreadsheet.

That’s just a huge time suck in my opinion, and not worth the effort when you can invest in something affordable or even free with many of the software options out there.

What I personally love about a bookkeeping software is being able to see at a glance, at any time, how much I’m bringing in and where I’d like to be in the future.

Conversely, I can see where I’m spending my money, and if I’m less profitable, I can quickly pinpoint where I’m overspending and adjust my budget accordingly for the rest of the month.

It’s really hard to have that kind of financial insight by just looking at your bank or Paypal accounts.

3. File Quarterly Estimated Taxes

You want to get comfortable filing quarterly estimated taxes.

That way, you won’t be surprised with a huge payment when tax season comes around.

You’ll already have money put aside for payments and have a pretty solid idea of how much you’ll need to give.

Bookkeeping software that you maintain and check regularly definitely helps you figure out how much estimated tax you owe.

4. Don’t Forget Sales Tax

This can be a steep learning curve for a lot of online business owners, but once you get the hang of it, it’s not too complicated.

Basically, you’ll need to collect separate sales tax for the state you live in – and, if your state has a nexus, you have to pay sales tax for that state as well.

A nexus is the requirement that sellers register as a business and collect and remit sales tax in any specific state, once they make sales over a certain amount.

The definition of nexus is different for every state, so you’ll need to do some research to find out the laws of each state you make a sale in.

If you try to do this manually, it’s a LOT of work – especially for online businesses who are potentially making sales in all 50 states.

That’s time you should be spending on doing marketing, making sales and money or designing new products.

That’s where TaxJar comes in.

I pay $20/month for TaxJar to keep track of my sales tax for me and tell me what states I need to collect sales tax for.

To me, it’s well worth the extra monthly cost to save me the time and risk of making a mistake by trying to handle this all on my own.

If you do choose to handle sales tax manually, it’s best practice to keep efficient records of every sale and track how many sales you’ve gotten from each state over each year.

When you pass the nexus threshold for a state, you have to start collecting taxes for that state.

If you don’t, that can be a huge headache and to me, it’s just not worth the risk of messing anything up.

With that in mind, I HIGHLY recommend TaxJar.

5. Accountants Can Be Optional

Although I know a lot of people employ one and they can be great if you need to get creative with saving on taxes.

But if you don’t have a very complicated tax profile, Turbotax is a super easy to use software to file taxes yourself.

When my businesses were still sole proprietorships or LLC’s, I used Turbotax.

If you need the extra support and would like customer support, you can always upgrade your Turbotax package to include consulting with a tax accountant, so you never have to feel lost.

It’s still way cheaper than working with an accountant.

I hope this helps you understand how to manage your taxes as a new business owner.

Yes, it seems daunting, but once you have your systems in place, it’s actually relatively simple.

Don’t let the fear of tax confusion keep you from starting your business.

It’s part of the process and it’s definitely one of the least fun parts, but it’s worth it!

Do you have any tips and tricks when it comes to taxes?

Let me know in the comments below – and be sure to check out my YouTube channel!

Leave a Comment

Liked this article? Share it!

Unlock a Profitable Handmade Business

in Just 12 Weeks Without Using Etsy

or Social Media

FREE WORKSHOP

This workshop is for anyone who makes and sells a handmade or physical product, including jewelry designers, artists, paper designers, bath & body product makers and more!

What You'll Discover

The #1 mistake people make with Etsy & social media that causes shops to FLOP

The secret to making it with your handmade shop so it's no longer just a hobby

How to make sales in your handmade shop with ease so you can finally get to 6-figures

TAKE ME THERE

Your email address will not be published. Required fields are marked *

Leave a Reply Cancel reply

About

Blog

A Sale A Day

Student Login

Free Class

Contact

Terms

Become A Student

Watch On YouTube

Student Reviews

See My Handmade Shop!

Hey Mei,

Thank you so much for sharing this information on how to manage taxes. This guide is really helpful to me. I just want to ask you one thing :- Do you have any excel sheet to calculate on taxes and record them?

Will be waiting for your revrt!

Do you enjoy playing video games? With the added challenge, fall guys is a fun and enjoyable game for people of all ages. Compete against the other participants. Compete in congested areas and overcome obstacle chapters to win.